Not known Facts About Mortgage Broker In Scarborough

Wiki Article

The Buzz on Mortgage Broker In Scarborough

Table of ContentsThe Only Guide to Mortgage BrokerMortgage Broker Scarborough - An OverviewSome Ideas on Mortgage Broker Scarborough You Should KnowMortgage Broker In Scarborough Fundamentals ExplainedThe Ultimate Guide To Mortgage Broker In ScarboroughAn Unbiased View of Mortgage Broker In Scarborough

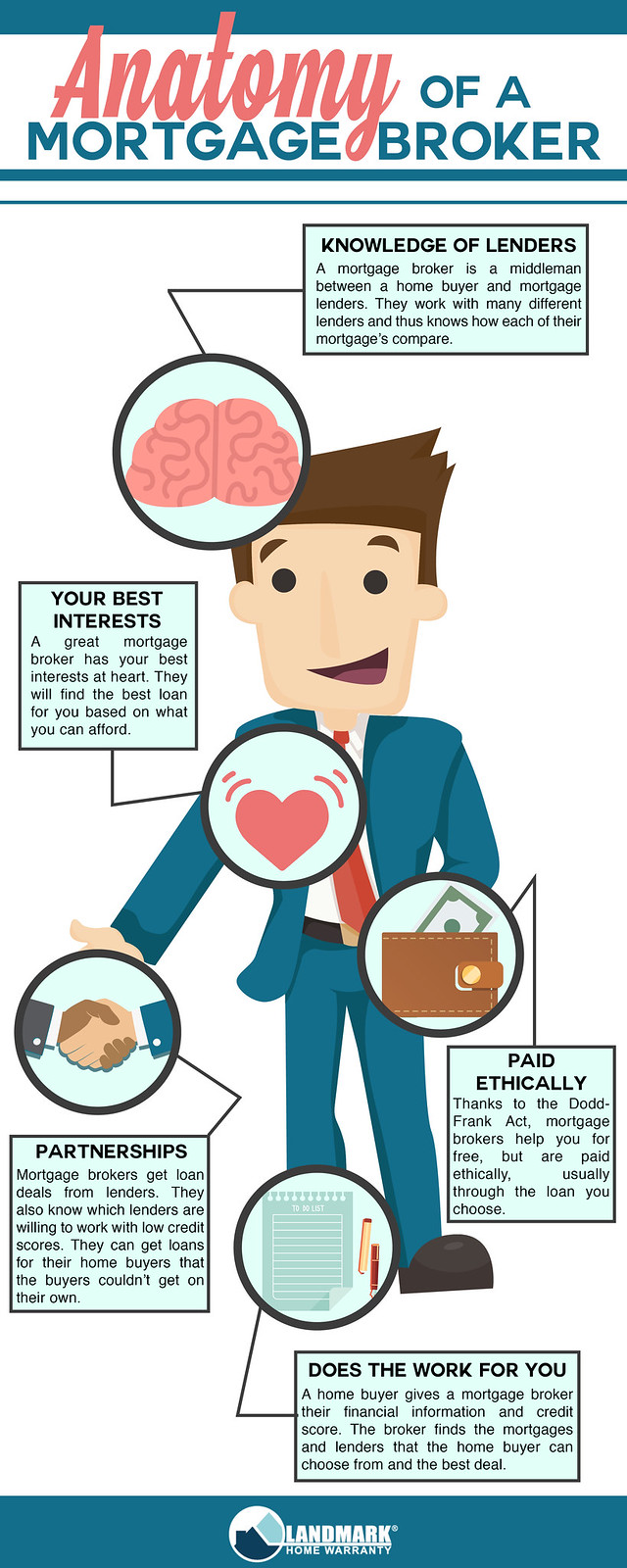

What Is a Mortgage Broker? A mortgage broker is an intermediary in between a banks that supplies finances that are secured with realty as well as individuals interested in purchasing property who need to borrow money in the type of a funding to do so. The home loan broker will certainly deal with both events to obtain the specific authorized for the finance.A mortgage broker generally functions with various lending institutions and also can offer a variety of finance alternatives to the customer they collaborate with. What Does a Home mortgage Broker Do? A mortgage broker intends to complete actual estate transactions as a third-party intermediary between a debtor as well as a lending institution. The broker will certainly accumulate details from the specific and also most likely to several lenders in order to find the most effective prospective loan for their client.

The Base Line: Do I Required A Home Mortgage Broker? Dealing with a home mortgage broker can conserve the debtor effort and time during the application process, and also potentially a great deal of money over the life of the financing. Additionally, some lenders function solely with mortgage brokers, meaning that borrowers would certainly have access to lendings that would certainly or else not be offered to them.

Indicators on Scarborough Mortgage Broker You Should Know

It's crucial to analyze all the charges, both those you might need to pay the broker, in addition to any costs the broker can help you prevent, when weighing the choice to work with a home mortgage broker.

What is a home loan broker? A mortgage broker acts as a middleman between you and also possible lending institutions. Home mortgage brokers have stables of lenders they work with, which can make your life much easier.

What Does Mortgage Broker In Scarborough Mean?

Just how does a mortgage broker get paid? Home loan brokers are most often paid by lenders, in some cases by consumers, description however, by law, never ever both.

Home loan brokers may be able to give borrowers access to a wide choice of financing types. You can conserve time by utilizing a mortgage broker; it can take hours to use for preapproval with various loan providers, then there's the back-and-forth interaction entailed in financing the finance and also making certain the transaction stays on track.

Not known Incorrect Statements About Mortgage Broker Near Me

When picking any loan provider whether via a broker or straight you'll desire to pay interest to lending institution charges." After that, take the Funding Quote you get from each lending institution, put them side by side as browse this site well as compare your interest price as well as all of the charges and closing prices.Exactly how do I choose a home loan broker? The finest means is to ask good friends and relatives for recommendations, yet make sure they have really used the broker as well as aren't simply dropping the name of a former university roomie or a remote colleague.

Ask your representative for the names of a few brokers that they have actually dealt with as well as depend on. Some real estate firms use an internal mortgage broker as part of their suite of solutions, yet you're not obligated to opt for that company or individual. Discovering the right home loan broker is much like picking the most effective mortgage loan provider: It's a good idea to interview a minimum of 3 individuals to figure out what solutions they provide, exactly how much experience they have and also just how they can aid streamline the procedure.

Mortgage Broker In Scarborough - The Facts

Regularly asked questions, What does a home mortgage broker do? A mortgage broker finds lending institutions with loans, rates, and terms to fit your demands.

Competition as well as residence rates will certainly influence exactly how much home mortgage brokers obtain paid. What's the distinction in between a mortgage broker and also a finance policeman? Car loan policemans work for one lender.

Acquiring a brand-new residence is just one of the most complex occasions in an individual's Website life. Quality vary significantly in terms of style, facilities, institution district and, naturally, the always essential "place, place, place." The mortgage application process is a challenging facet of the homebuying process, especially for those without previous experience - mortgage broker Scarborough.

Facts About Mortgage Broker Scarborough Revealed

Report this wiki page